What Is A Yield Curve?

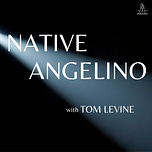

The treasury yield curve is a graph that charts the interest rate on Treasury bonds, notes, and bills versus their maturity (the time until they pay back principal).

Normally it slopes upward, from left to right. When you think about it, it makes sense. Bondholders demand a higher rate of interest to lend money (i.e., hold bonds) for a longer period of time. What Is An Inverted Yield Curve?

What Is An Inverted Yield Curve?

When the curve is "inverted," it is downward sloping from left to right, which means you will be paid less to hold bonds for a longer time. This scenario makes no sense for the individual investor. Why would you invest to earn less interest on a 30-year bond than on a 2-year bond? In most cases, you wouldn't.

Why Does An Inversion Matter?

An inverted, 3month to 10year USTreasury yield curve has had strong predictive power that a recession is coming. Typically, the recession is roughly 2 years out.

A normal, upward-sloping curve suggests that the economic outlook is positive. Better times are anticipated, and as one would expect, it costs more to borrow money for the long term, and one receives a higher rate of interest to invest long term.

An inverted, downward-sloping curve suggests that the outlook is negative or the economy is slowing.

Is This Time Different?

In September of 2018, I wrote a post entitled "Is This Time Different?" which asked, "Does A Flattening Yield Curve Predict A Recession?"

Rick Santelli of CNBC interviewed Arturo Estrella of the Federal Reserve Bank of New York. Estrella stated that an inverted yield curve between 3 month Treasury Bills and 10 Year Treasury Bonds had predicted all 7 U.S. recessions that have occurred since 1968.

Currently, the 3mos/10yr remains positively sloped; the 2yr/10yr and 5yr/10yr are negatively sloped or inverted and the curve all the way from 10 years to 30 years is almost flat.

The 2yr/10yr inversion has been less accurate at predicting a recession than the 3mos/10yr spread.

What Are The Bond Gurus Saying?

Mohamed El-Erian - Allianz

Stagflation is the baseline.

This is the time to take some chips off the table.

Jeff Gundlach - DoubleLine - “The New Bond King”

Right on cue, the "It Doesn't Matter This Time" white papers are coming out, the DoubleLine Capital CEO tweeted. "Don't believe them."

Bill Gross - PIMCO retired - “The Bond King”

Bonds are definitely something to avoid.

They (the Fed) are way behind the curve.

If the ten year goes to 3, 3 1/2, or 4%, it will break the economy.

50-100bps more from the Fed and we will see a recession.

Inflation will be 4-5%.

Bill Gross referring to Jeff Gudlach:

To be a bond king, you have to have a kingdom. PIMCO was $1-2 trillion, Gundlach has $134 billion and is not growing.

Central banks and governments are the new bond kings and queens. The term is somewhat passe.

Bill Gross referring to Cathy Wood

She doesn’t have an excellent sense of value and when to buy and what to pay. She seems to think that down the road her theory will be validated.

For a more technical discussion of the yield curve inversion please watch the following video:

***NOTE: There are 12 zeros in a trillion, 9 in a billion and 6 in a million. I incorrectly stated 18 per trillion in the recording. Apologies.***

The Author And Podcast Host, Tom Levine

Following a 25 year career in capital markets, Tom Levine founded Zero Hour Group in 2014.

The Los Angeles, California-based firm provides consulting, strategic analysis, and real estate services.

Services are offered nationwide and across a variety of sectors. The firm's clients range from family offices and high net worth individuals to institutions and professional investors.

Real Estate related transactions are brokered through our subsidary firms, Native Angelino Real Estate and WEHO Realtor.

Tom Levine is a Native Angelino and graduate of USC Marshall School of Business, Claremont Colleges, and spent a term at the London School of Economics. Additionally, he is a certified Short Sale Specialist under the National Association of Realtors.

Podcast

The Native Angelino Podcast is underwritten and produced in conjunction with the Zero Hour Group, a consulting and strategy firm, parent to 1929, Native Angelino Real Estate, and associated real estate assets.

Native Angelino description found on iTunes:

“From a vantage point within sight of the Hollywood Sign, seated beneath a palm tree, Tom Levine takes you on a twisted, exploratory tour of popular thought, the upside-down theories of classical economics, politics, and other strange things.

Tom talks all things Los Angeles, bright new ideas, and complex topics of interest to creative thinkers and discerning skeptics.

L.A. locals state with pride, "You can surf in the morning and ski in the afternoon." Well, if you get a really early start, it's true. Sometimes.

Los Angeles is the City of the Angels, and Tom Levine is a Native Angelino.

Share this post